Friday, December 18, 2009

The reset button

The currency collapse itself is not really the problem for most of the population. Suppose for a moment that we could be done with the currency collapse instantaneously, but without the economy being destroyed. Dollars, whether they are dollars you have saved or dollars that you owe, suddenly cease to exist. Instead, paychecks magically begin arriving in the new currency, and we all switch over to the new money for all transactions.

This wipes out savings, but it also wipes out debts. It's like pressing a giant reset button, and most Americans would choose to push that button. Not the wealthy Americans, not the top of the middle class-- but most of us. Even middle class Americans with sizeable 401k accounts might push the button, since not having to make mortgage, car loan, student loan, and credit card payments would free up so much income that they could easily catch up as far as retirement.

We would certainly have to adopt, and immediately, a real safety net for the elderly. But with all US sovereign debt wiped out we would be more able to do this than we are now. Furthermore, if the new currency were backed by gold and/or silver, this would prevent the relentless inflation which has eroded Social Security payments year after year. (Yes, SS payments are supposed to increase with inflation, but then, the government lies its ass off about inflation, so it doesn't quite work that way.)

Without debts, government or private, we could resume real growth. If other nations were wary of doing business with us due to the recent currency change, all the better, as that might revitalize domestic production.

People lament hyperinflation because it "wipes out the assets of the middle class," but really, how many Americans have more assets than debts? And whatever assets they do have may be relatively inaccessible, e.g. tied up in the house they live in, the paid-off car they drive, or in retirement accounts they are decades away from tapping.

Again, most of us would gladly push reset. Or-- we would in this magical world I've just described. In real life the death of a currency takes a while and gets seriously messy. It brings the real economy to a screeching halt. The question is not "how do we save the dollar?" when it cannot be saved. The question should be how we transition as rapidly as possible to a gold- or silver-backed new currency, once the dollar finally begins to fall apart. The longer it takes, the more production is lost, and the more we all suffer.

Wednesday, December 16, 2009

7 causes of deflation during a currency collapse

1) Continuation of existing deflation. Currency failures tend to occur in the midst of terrible economies. After all, if there is more and more paper and less and less production, a loss of confidence in that paper is just a matter of time. Or, as I've heard it said recently: "Deflation is the midwife of hyperinflation." If you had an unhealthy economy before, it is not going to be reinvigorated by a failing currency.

2) Disruption of business due to price instability. Businesses fail to take into account escalating price inflation and wind up bankrupt. Businesses close, jobs are lost, and production declines.

3) Money supply is shrinking in real terms. There's a point of no return, a sort of event horizon, beyond which prices increase faster than the rate of money printing. Say the government is printing so fast that the money supply will increase 20-fold this year. If you are past the point of no return (characterized by sky-high money velocity), then prices will go up more than 20-fold, perhaps more like 30- or 50-fold. Which means that in terms of "stuff," or gold, there is less total money in circulation. (Note that a decrease in the supply of money is the Austrian definition of deflation.)

4) Price controls destroy production. Governments always attempt to demonize merchants and pass laws capping prices, which causes factories and farms to simply shut down, because it would cost more to produce their goods than they would ever get back.

5) Capital is destroyed. Businesses and many wealthy families have their savings wiped out, meaning there is less capital to invest in means of production.

6) Capital goes on strike. Even when capital is preserved by being moved off-shore or into gold, silver, antiques, landed estates, etc, this capital is not available to industry. Gold has sometimes been called "capital on strike," since the rich move into gold when economic conditions are dire or chaotic, as there are no viable investments. The elites are merely interested in wealth preservation, not in traditional forms of investment, which no longer make any sense. Thus, any remaining capital is sunk into unproductive stores of value and production suffers.

7) Fatalism sets in. There are fascinating descriptions of the psychology of Germans in the Weimar era, and of other times and places which have gone through hyperinflation. Saving and planning for the future have failed as savings are wiped out, and chaos now reigns, so people stop planning. Society begins breaking down: crime increases, moral or behavioral standards go out the window, and people live in the moment. When this happens on a societal scale I can only assume it hampers production.

What happens to prices in nominal terms doesn't matter, not once middle class savings have been destroyed and pensions have been made worthless. By that point, a price or a wage or the total money supply as measured in the currency are all irrelevant. What matters is how many minutes of labor are required to buy X units of "stuff," and there you will find that more and more labor is required to buy less and less stuff. And to the man and woman on the street that's all that matters.

Tuesday, December 15, 2009

The second wave

The chart (stolen from a Casey Research article) shows how many mortgages re-set to a new payment, usually higher. With the sub-prime fiasco, people often had low initial interest rates, a lot like the teaser rate on a new credit card. Once the interest rate reset to a higher level, the payment increased and people defaulted in droves.

The chart (stolen from a Casey Research article) shows how many mortgages re-set to a new payment, usually higher. With the sub-prime fiasco, people often had low initial interest rates, a lot like the teaser rate on a new credit card. Once the interest rate reset to a higher level, the payment increased and people defaulted in droves.Option ARMs are even worse, since they allow people to (for example) pay only the interest and none of the principal for the first X years. Or, in some cases, people paid even less than that, and the total amount of the loan was actually growing over time because they weren't even keeping up with the interest. Many of these folks will be doubly screwed when the "teaser" period expires and they have to begin making normal payments. Not only will they be typical principal + interest payments, but the interest will be calculated at a higher rate. Defaults galore!

Also, prime mortgages are defaulting these days due to job losses, which was not the case when the sub-prime debacle began.

We have a long way to fall in housing, even now. If you own a house on a fixed-rate mortgage and the payments are manageable, congratulations, you'll be paying off the mortgage early when the dollar hyperinflates. If you don't own a house, congratulations, housing should be dirt cheap in a few more years. And, because we are approaching the long-awaited stock market crash (yes, I was very early and have learned the hard way just how long the market can stay irrational)... well, gold and silver will get knocked down a peg as well. Which is to say, they'll be on sale! For cheap! And the precious metals are a safer way to accumulate savings than by depending on the dollar-- whose fate, as with every other fiat currency, is sealed.

Wednesday, December 9, 2009

Collapsing tax revenues

Zero Hedge informs us, in Collapse in Tax Withholdings Refutes Improvements in Either Unemployment or Corporate Profitability, that withholdings from employees' wages were down almost 8% last month as compared with the same month a year ago. These are the Social Security and Medicare withholdings, mostly SS. And the SS tax applies only to the first $107,000 a person earns per year. So if the rich bankers have lesser bonuses this year (ha! not likely!) it wouldn't show up in this (much). This is mostly the middle and working class who are seeing a decline in total wages.

Furthermore, corporations must withhold a portion of their earnings to be paid in taxes, and these withholdings are down (get this) 64% compared to last year. Holy cow!! Remind me why the stock market has rallied massively since March?

Moreover, Mish has been watching state tax revenues fall. State and county sales tax revenues in New York were down over 8 percent. In Georgia they were down 16%; in Texas, 12.5%. Iowa's tax revenues missed their government's predictions by over 7%, while in California they missed by over 5%. Revenues in Kentucky were down almost 10% and in Indiana they were off 14%. You get the idea.

Many states have laws saying they must balance the budget. With plunging revenues this must mean they lay off workers. Incidentally, education was one of the only job sectors to show growth in the last B(L)S employment report. If that was ever true -- which is doubtful -- it certainly is not a sustainable trend, since state and local taxes pay teacher's salaries.

In Illinois some state colleges are not receiving promised payments from the state government:

"We have run our entire system for nearly a half a year with no payments from the state," Poshard said. But if the state doesn't kick in with its payments -- which comprise approximately 60 percent of university budgets -- the university will run out of money to make its payroll by December.

In New Jersey, payrolls are also in jeopardy:

"Things are probably worse than most people believe," state Sen. Mike Doherty told me the other day. "It’s questionable if we’ll even be able to meet payroll in a few weeks."

Zero Hedge summarizes it this way:

Hopefully the administration by now has realized that unless it wants uprisings (either metaphoric or literal ones) it has to tackle the state situation. As today's Census Bureau update points out... total state revenues dropped by 16% to $1.678 trillion, even as total expenses increased by 6.2% to $1.736 trillion.

On the plus side, lottery and liquor sale revenues are up.

Monday, December 7, 2009

Interview on hyperinflation

In an interview this past weekend on King World News he laid out, in his usual calm way, his estimate that the United States could face hyperinflation within 1 to 3 years:

In this interview John discusses looming hyperinflation, staggering unemployment, the reality of the US economy, the Fed’s inability to stimulate the economy, consumer’s inability to spend, the coming collapse of the US Dollar, how listeners need to prepare themselves for this crisis, the Fed’s debasement of the Dollar, an intensifying great depression, disappearance of cash as we know it and more.

Back in the summer of 2008 Williams issued a now-famous Special Report on Hyperinflation where he predicted it would set in between 2010 and 2018. So he's revised the timeline in the belief that dollar collapse will come sooner than he previously thought, due to the Fed's massive money printing in the past year. The interview is excellent and worth downloading.

To clarify, since hyperinflation has no agreed-upon, set definition, Williams' definition is when the largest circulating bill becomes more functional as toilet paper than as currency. This would be the $100 bill in our case... made worthless. Sometime in the 2010-2012 period.

And this, I should mention, agrees with reports from Lindsey Williams. Put on your tinfoil hat for a minute and lend me your ear. Williams is a minister who happened to spend quality time with a few elites in the early 70s, while working on Alaskan oil pipelines. (Yes, it's weird-- they hired him as a chaplain for their employees.) And he's being used by one of these very elite guys (think Bilderberg) to pass along leaked information. Back in spring 2008 Williams' source told him that oil -- then well above $100 / barrel and headed ultimately for almost $150 -- would crash to below $50 within a year. Williams went on radio to pass this along, and I had a very clear response to this, which was: "Bullshit!" But since Williams was right on that (and apparently on a number of past predictions), I feel I should listen to him with half an ear. His source recently told him that the dollar collapse timeline had been delayed by the elites because they were given so many trillions of dollars by the Fed and US government -- more trillions, apparently, than they had hoped for in their wildest dreams -- and it was taking them some time to convert all that paper into things of real value. So, instead of the dollar being in its death spiral already, it has been held up to give the uber-rich time to exit their dollar positions. This will not last much longer, however, as Williams' source said the dollar would be toast within 2 years. Take it for whatever it's worth-- it's just interesting that the timeline is similar.

Safest way to think about it is that 2010 is the last year of the dollar. For those of you with no money or assets, well hey, you won't have any wealth to evaporate the way middle class 401k's will. And those student loans? Ha! You'll be paying them off with pocket change. If you have very little to spare, concentrate on food... stockpiling it or moving closer to it. I wouldn't want to live in Phoenix, that's all I'm sayin'.

Thursday, December 3, 2009

No jobs, no recovery

Mish reported yesterday that 24 states are having to borrow money to meet unemployment benefits payments. North Carolina has so far borrowed an amount equal to 21% of its annual budget.

It gets worse. The debt is still rising. The problem is that with about 500,000 people out of work, the state has more unemployment claims than it can pay. So it has been borrowing from the federal government since February, sometimes as much as $20 million a day.

States will be further hit when the health care legislation passes, as Medicaid costs (paid by states) will increase, without commensurate increases in federal aid. And at least 10 states are already in very serious trouble:

A study released Wednesday warned that at least nine other big states [besides California] are also barreling toward economic disaster, raising the likelihood of higher taxes, more government layoffs and deep cuts in services.

The report by the Pew Center on the States found that Arizona, Florida, Illinois, Michigan, Nevada, New Jersey, Oregon, Rhode Island and Wisconsin are also at grave risk....

The 10 states account for more than one-third of the nation's population and economic output, according to the report.

State and local governments have total budget shortfalls of around half a trillion dollars for this fiscal year. And states and local governments cannot print their own money, which means they'll have to beg for aid from the feds. Yet even if the feds come through with major bailouts, states will still be forced to cut expenses dramatically. Goldman traders may not have to give up their bonuses, but you can bet your local school will be giving up its teacher's aides. Have you ever seen the IMF come in to give "aid" to an impoverished nation? It demands as much austerity as it thinks the people can stand without it causing a revolution. And if there's anything useful in the country, any natural resources, those are sold off to somebody else. That's the Washington model for you. So if California needs to be bailed out, so be it, but there will be as many kids in a classroom as they can physically pack in. The homeless shelters will close, the potholes will never be filled, and the forest fires can consume as many homes or hamlets as may be. Everything will be cut to the bone, including payrolls.

In a long and detailed post, Mish made some predictions for the unemployment rate over the next several years. His conclusion is enough to make you weep.

Yet, in spite of all those generous assumptions, no double dip recession, no second recession, high rates of job growth and falling participation rates all the way through 2020, and unemployment peaking at 11.6% not 13%, the best I can do is suggest the unemployment rate will be over 10% all the way through 2015 and never dip below 8% all the way out through the end of 2020.

His "generous assumptions" will not be met, of course; the reality will be worse than that. We'll have this level of unemployment for another decade, in other words. At least this level. Next year is sure to be higher.

When people can no longer borrow, they must be able to earn money if we're to have a functioning economy. Without jobs the deflation will worsen, because the Free Money Fiesta over at the Federal Reserve does not include you and me. It doesn't even matter what happens to the dollar. Inflation or no inflation, we will still have deflation in real terms. Weimar Germany had absolutely terrible deflation when measured in real terms (i.e. if you convert all sales into gold gram equivalents)-- they had more than a 90% fall in gold-denominated GDP. In fact, the currency failure (hyperinflation) was a huge factor in causing the disruption and collapse of commerce. If the dollar collapses it will only exacerbate the real life economic slowdown that we normally think of as "deflationary."

It isn't as if nobody has any ideas about how to ameliorate this economic disaster we're headed into. Webster Tarpley has suggested a 1% tax on financial transactions (known as the Tobin Tax, which also means death to Goldman Sachs' beloved high-frequency trading). He's also suggested 0% interest loans to production and manufacturing, and real stimulus along the lines of the Tennessee Valley Authority, including high-speed rail lines, local public transportation, and nuclear power. Bob Chapman has suggested using tariffs to force a revitalization of domestic production. Catherine Austin Fitts advocates local business and local banking, or in other words, decentralized production.

Basically we need to reverse globalization and start making things where we live. What we produce translates into our communal wealth; production is wealth. I suppose the elites on Wall Street don't care for this idea since they themselves produce nothing at all.

Wednesday, December 2, 2009

We're not going back to normal

And when I hear people talk like this, even when they are speaking directly to me, I don't say anything about my views on the US economic situation. I don't point out that one in 5 American workers can't find a job and that most of the missing jobs are gone until after the dollar collapses, a situation known euphemistically as "structural unemployment." The word "structural" here means it's built into the system. If you offshore all production and manufacturing, "structural" or permanent unemployment is what you get. No fixing that until we hyperinflate the dollar into oblivion and we are forced to produce things domestically because we can no longer afford imports.

And no point mentioning that one in 4 children relies on food stamps to get enough to eat, suggesting we are a developing nation. Or that all the campgrounds within 100 miles of Los Angeles are filled with homeless people. If it's not on television it might as well not exist.

And I don't mention that next year we will have to borrow around $1.5 trillion to make up the budget shortfall, plus we'll have to "roll over" or re-borrow another $1.9 trillion because a slew of short-term loans must be repaid, and naturally, we don't have the money. If numbers or math are involved, nobody wants to hear it. But that's $2.4 trillion we'll need to borrow next year, which is godawful. That's over $9 billion we'll expect the rest of the world to give us every single business day. And if they don't? If they refuse? Then we print the money to cover our bills, and erode our currency, and thus erode the savings and assets of the middle class. Or, if we don't print it, we must make drastic cuts in government, and that would be very painful to the American people because government expenditures make up 36% of our GDP.

Almost the entirety of the GDP is consumer spending and government spending -- which is, in fact, normal for all nations -- but the problem here is that consumers are spending borrowed money and so is the government. Only... the borrowing is gradually coming to a halt as credit dries up.

We have two choices.

The first is, we simply allow the credit and loans to disappear, we let the "liquidity" dry up, and suffer the consequences. This results in economic collapse. Forget the term "deflation," as that does not get the idea across. The economy collapses. Commerce largely evaporates. The US defaults on its sovereign debt, as do virtually all US states and municipalities as well as many corporations.

The second is, we print enough brand-new money to keep the "liquidity" flowing, but that money has a rapidly shrinking real value. I mean, you can't just print new money out of nothing and expect it to maintain the same value as the old money. The value has to shrink. Which means prices have to go up in dollar terms. If this process gets out of control (which historically is likely) then the dollar collapses until it has no value at all, until it is useful only as toilet paper or kindling. Which means commerce largely evaporates and businesses close because nobody can deal with the lack of viable currency. This is probably worse than the first scenario, but it's what the US government will attempt. Politicians always hope -- and perhaps truly believe -- that they can maneuver just a bit of inflation, enough to ease the debt burdens and keep commerce alive, but not so much that they ruin the currency.

Either route is disastrous. But even if I said all this to most of my friends and acquaintances, almost none of them would do a thing to make preparations for such miserable scenarios. It's one thing to build a bomb shelter against nuclear war; we've never had a nuclear war. Or to buy potassium iodate tablets; we've never had a dirty bomb attack. Or to buy batteries and food and water before y2k; that was similarly unprecedented. Hyperinflation, however, is not only common, it is always and without exception the fate of a fiat currency. It is not a novel catastrophe. This is a routine human experience, and it's a hell of a bad experience. During the currency crisis in Argentina, middle class men would dress in suits to go out looking for work in the mornings, but by afternoon would be seen in alleys picking through trash for something to eat. Not only has this happened in many other nations, it has happened twice in our own nation.

But Americans, I think, are addicted to a feeling of normalcy. We like to be cheerful and positive, for one thing, and so we reject gloomy predictions. But we especially like to turn on the TV or go to the mall or the movies and be bathed in the sense that all is well, the world is still functioning, and the US is still the greatest nation on Earth. And that is why nobody will have any cash when the banks announce withdrawal limits or outright closures; that is why nobody will have food when distribution begins to break down; that is why nobody will have alternative forms of money such as gold, silver, or copper coins when the paper stuff begins to go haywire.

And Americans don't care a whit about history. We seem to believe that we have achieved the permanent utopia (with slight fluctuations) of the Technology Age, and that calamity is virtually impossible. The Experts know how to keep us safe, but in the unlikely event of a crisis, The Experts will take care of us. You know, like they did for the people of New Orleans.

We're clinging to the old normal as best we can, but it simply can't last.

Wednesday, November 11, 2009

Blessed Blankfein

Just call him Lloyd Marie Antoinette Blankfein.

Tom Gregory over at HuffPo put up a hilarious response as follows:

THE LLOYD's Prayer

Our Chairman,

Who Art At Goldman,

Blankfein Be Thy Name.

The Rally's Come. God's Work Be Done

On Earth As There's No Fear Of Correction.Give Us This Day Our Daily Gains,

Goldman.

And Bankrupt Our Competitors

As You Taught Lehman and Bear Their Lessons.

And Bring Us Not Under Indictment.

For Thine Is The Treasury,

The House And The Senate

Forever and Ever.

Goldman's performance in the markets was so spectacular last quarter that they only lost money on 1 out of 65 trading days. You cannot do that without massive corruption. It's simply impossible. With this "God" reference, perhaps Mr. Blankfein is arguing that it wasn't criminal behavior-- it was Divine Intervention.

Monday, November 9, 2009

Losing faith

From an elitist's perspective, the most fantastic form of money yet devised is paper. It has less utility than seashells (which after all are made of minerals), or peppercorns, or sticks. Even the lowly stick can be burned for warmth. (The British had loads of these very old sticks lying around in the Houses of Parliament, and in 1834 they got the brilliant idea of destroying them in a stove, whereupon the entire Parliament burned down. That was some seriously dry wood.)

But fiat paper money doesn't represent any tangible goods whatsoever. (Over 90% of our "paper" money is actually just a computer entry somewhere.) Paper money is an object of collective faith. That could be said about any of the other forms of money, too; but the thing with paper is that it can be created by governments, in enormous quantities, at will. Money printing makes the currency less rare and therefore less valuable, robbing the people of their savings.

Whatever governmental mistakes bring about the failure of a currency, in the actual moment when it tilts over the precipice and plummets in value, it's mass psychology that does it. It's a sudden, widespread loss of confidence in the value of the currency.

I note that people are already losing confidence in Wall Street, in the Treasury, in the Presidency (that is, in the position itself), in Congress, in the two-party system, in the People themselves. This is to say nothing of the sense of decline one gets from the new crappy houses with deteriorating siding and toxic drywall, the clothing made of increasingly thin material, the ruined historical buildings and town centers, the shrinking food packages, the disintegrating barns and silos, the uglier and emptier strip malls, the rusting factories, the increasing drop-out and illiteracy rates. As an Empire, we are through. Stick a fork in us, we're done.

As for the financial world, I wouldn't know where to begin or how to express how criminal, insane, and plainly dangerous the markets have become. On blogs where people are knowledgeable about these things, the cynicism and bitterness are rampant (although there's a lot of humor, too-- what can you do but laugh?). Nothing in the financial world is considered to have any meaning anymore, because it's all disconnected from the real world and the real economy.

In short, there's not a lot of confidence in the institutions surrounding the dollar, nor in the society that exports all these dollars, nor in the international banking system in which the dollar operates. Psychologically speaking, the supports are being knocked out one by one.

You can start to prepare yourself for this coming distrust of paper money by taking out a bill-- not a one-dollar bill, but say a twenty-- and recognizing that it is just a bit of cotton and ink. Seriously. The only reason you can hand it over and get gas or jeans or eggs in return is because the guy taking your money is an idiot. Okay, not an idiot, but willfully blind, in the manner of the villagers praising the non-existent clothing of their emperor.

Another tactic is to imagine yourself on a desert island with a big wad of tens and twenties. You're screwed, right? Now imagine you get one hour to shop at a Super Wal-Mart before we drop you and your stuff off for two weeks on that same barren island. Makes it pretty clear what's really important, doesn't it?

This is NOT all survivalist thinking. Actually there is a very long-term cycle in which for a couple of decades or more, financial assets (paper) do very well. And then they get way over-valued and there is a return to real assets (also known as hard or tangible assets) such as gold, silver, real estate, agricultural commodities, crude oil, natural gas, base metals, etc. We are now exiting the overblown paper party, and hard assets will be far superior investments for the foreseeable future.

But it's true, it's pretty easy to understand at a survivalist level. If you have loads of cash, you assume that can be turned into wheat or clothing or firewood or batteries at your convenience. Essentially those dollars are someone else's future promise to give you stuff. As long as nothing goes wrong, these future cashiers can keep that promise, and you won't have to do without.

As long as nothing goes wrong. I mean, as long as people don't change their minds and start worrying about the bits of cotton in their wallets. If people start worrying, en masse, then in the blink of an eye the stores may no longer have that stuff you meant to buy. Whatever can be reasonably converted today from "colored cotton paper" into "stuff" should be converted. A great many things last almost forever: toilet paper, soap, salt, sugar, popcorn, properly stored firewood, wool blankets, oil lamps & oil, Coleman stoves & fuel canisters. Think of it as making an investment change from paper assets to hard assets, and try to get it done before all faith in paper is lost.

Sunday, November 8, 2009

Still losing jobs, no end in sight

Last week the official unemployment rate hit 10.2%, meaning that -- and here comes the tricky bit -- among those still considered part of the American work force, 1 in 10 are out of a job. However, if you've given up looking for a job because there are none (think of a construction worker in Florida or Arizona), then you don't count. If you've been out of work over 6 months, you also don't count.

And it doesn't matter whether your job is enough to survive on, either. If you used to work full time, and now the only job you can find is for 8 hours per week, it doesn't matter. That's considered "employed". If you are a self-employed real estate agent who hasn't sold a home in 6 months-- you guessed it! Employed.

If you put the "discouraged workers," the long-term unemployed, and the under-employed into the unemployment category, our unemployment rate is 17.5%. But even that's an underestimate, since various administrations have finagled this number in order to soften the bad news. Economist John Williams calculates this unemployment figure the way it was calculated prior to the Clinton administration, and his figure is 22.1% unemployment.

In truth, then, at least 1 in 5 American workers cannot find a job.

Meanwhile, those still employed are being squeezed mercilessly. Wall Street was just frickin' ecstatic over this bit of news from last Thursday:

The Labor Department said the output per hour of nonfarm workers rose at an annual rate of 9.5% in the quarter, more than four times the average productivity growth rate of the past quarter-century. When taken together with the second quarter's 6.9% rise, it was the strongest productivity growth rate over a six-month period since 1961.

Woo-hoo! CEO's are going to get almost 10% more work out of people this year, and all without paying them a red cent more! Bust out the champagne on the floor of the NYSE!

Disgusting. In the past 6 months, the output per hour of work has increased dramatically while worker's incomes have been flat or falling. This increased productivity has meant that more workers can be let go, or not hired back. In effect, Wall Street was cheering the fact that companies won't have to employ as many people.

Meanwhile the government claims it saved or created 640,329 jobs via its stimulus plan. As Mish points out, if that's true then it means they spent $323,739.83 per job. I don't know about you, but that doesn't look too impressive.

Furthermore, more than half those jobs were in government, meaning that government must continue to pay over 320,000 salaries indefinitely. The Obama administration had promised that 90% of the jobs would come from the private sector, in effect assuring us that government wouldn't have to keep paying for these jobs by paying the salaries year after year. But in fact, the minority of new jobs were in the private sector; most must be funded by government in perpetuity.

But this jobs number turns out to be entirely bogus, because (get this) pay raises were counted as new jobs.

Uh-huh. You read that right. Check it out over at The Automatic Earth:

AP found, just to name an example, that of 14,506 jobs allegedly saved or created by just one federal agency, two-thirds (!) were not saved or created at all. They were counted because existing government employees got pay raises.

An unfortunate and isolated accident? No, it's not. The administration has even issued directives to count pay raises as saved jobs. AP: "The inflated job count is at least partly the product of the administration instructing local community agencies that received money to count the raises as jobs saved."

You can't make this stuff up!

Who knows what we spent on the few measly jobs we did manage to create. Half a million each? A million apiece? And even if the Obama administration had been correct, and we had saved or created 640,000 jobs, that still would be terribly disappointing considering that unemployment rolls show 559,000 people lost jobs just last month.

Of course, the Bureau of Labor Statistics or BLS -- also known as the Bureau of Lies and Statistics -- says we only lost 190,000 jobs last month. But this is a much-manipulated estimate based on the bogus "birth and death model" which we now know has vastly underestimated job losses throughout 2009. The BLS will correct this understatement of lost jobs after the end of the year. Still, even according to these rosy-colored BLS numbers we have lost 2.8 million jobs since the stimulus plan was passed roughly 10 months ago.

The blue lines in the graph below show the estimated unemployment rate, without any stimulus plan (the higher light blue line) or with the stimulus (the lower dark blue line). Reality is a bitch... the real numbers are in red.

Meanwhile the Goldman crowd continues to suck down their hundreds of thousands in bonuses and the Too Big to Fail banks (more like So Big We Can Screw You) throw multiple trillions of our dollars into their black hole, bankrupt coffers. Who needs production? We gotta save the bankers!

Massive income disparity is not financially healthy and usually leads to a ruined economy and major social unrest. You would think the banking elites must know this, yet they appear to think Things Are Different This Time, and that they have nothing to fear from the masses. Meaningless pop culture, electronic toys, public schooling, and controlled media make Americans so passive -- or so the popular thinking goes -- that they couldn't lift a torch if their children were starving. Well, I don't think so. In fact, Americans have such a sense of entitlement that they're liable to be far more pissed off about their falling standard of living than the citizens of many other nations.

Unrest doesn't have to be sparked by anything directly related to joblessness, foreclosures, or other economic problems. Last December, during rioting in Greece, 16 bank branches were burned down. The riots weren't about the banks or the economy, but had been ignited when police murdered an unarmed teenaged boy. Nonetheless, the underlying economic discontent was enough that banks were targeted.

Jobs are not simply the key to economic health, they are also the best way to prevent civil unrest. And yet with all the money being spent, virtually nothing is being done to bring work back to the United States. According to Mish in a recent interview, we still give tax benefits to corporations' overseas operations which they cannot get for US operations. In other words, the US Congress is continuing to give incentives to US companies to offshore their labor, even as we speak.

As Jim Kunstler has said, once the first window gets broken, all bets are off.

Policemen stand by the burned Emboriki Bank in central Athens on December 9, 2008. AFP PHOTO /Louisa Gouliamaki

Tuesday, November 3, 2009

Disaster is inevitable

I'm going to translate from a newsletter written by a well-respected money guy named Eric Sprott. I can't offer any expertise in economics, but what I can hopefully offer is a translation service into plain English. The excerpts below are from the October 2009 issue, Dead Government Walking.

[T]he United States Government is on a trajectory to default on their obligations. In its current financial condition, it will not be able to fund its forecasted budget deficits and unfunded Social Security and Medicare promises on top of its current debt obligations.

That is, there will be no Social Security or Medicare for most of us. Imagine a company that was setting aside money for its employee pension plan, only every single year they "borrowed" the entire amount that was supposed to go into pension funds, and instead used it to make payroll. That's what the US government did. There is no Social Security money. We just figured we could borrow or raise taxes when the time came. Ha! Not so much.

[T]he financial condition of the US government is completely untenable. The projected US deficit from 2009 to 2019 is now slated to be almost $9 trillion dollars. How on earth does anyone expect them to raise this capital?

In other words, the rest of the world cannot afford to loan us $9,000,000,000,000 over the course of the next decade when everyone is broke.

As we stated in a previous article, in order to satisfy US capital requirements, all existing investors would have had to increase their US bond purchases by 200% in fiscal 2009. Foreigners, however, only increased their purchases by a mere 28% from September 2008 to July 2009 - far short of what the US government required.

So here's a similar example. Suppose that last year you had to put $1,000 on your credit card to make ends meet. This year your income is lower and your expenses are greater, and you know you're going to need to borrow $3,000. But then your credit card company sends you a letter announcing that your credit limit is being lowered to $2,280. You can only borrow another $1,280 this year, far short of what you need to get by. But here is where the difference comes in: you don't have a printing press with which to counterfeit money to make up the difference. The government does. And boy howdy, they use it.

[T]he Federal Reserve isn’t merely supporting the market for US treasuries… it is the market for US treasuries. Printing new dollars to support an almost $9 trillion dollar budget deficit that stretches out over the next ten years puts the US on the road to ruin....

In other words we print money and buy our own Treasuries. It's like transferring counterfeit money from your left pocket to your right, and pretending that all money in the right-hand pocket is now magically legitimate. Here in the real world, as it says above, that puts you on a very bad path. One that often leads to hunger, and occasionally leads to guillotines or fascism.

Taxing the citizens is another possibility, one that doesn't involve borrowing or printing, and thus seems a tad more responsible. But here we run into the principle that "you can't get blood out of a stone":

Can't borrow it, can't get it from taxes. That leaves only breaking promises and printing money, both of which will undoubtedly take place.

The US taxpayer can’t cover the difference either. According to recent estimates, tax revenue from all sources would have to increase by 61% in order to balance the 2010 fiscal budget. Given that State government income tax revenues were down 27.5% in the second quarter, the US government will be lucky just to maintain its current level

of tax revenue, let alone increase it....

Hemingway wrote that a man goes broke “slowly, then all at once”. We believe the same sentiment can be applied to governments....

Like dead men walking, the US government is merely biding its time until the moment of truth. Unlike Fannie Mae, General Motors or Citigroup, however, there is no one left to grant a reprieve.

Monday, November 2, 2009

The Japan risk

A totally new danger -- new to me, anyway -- was brought to my attention today by Ambrose Evans-Pritchard in his article It is Japan we should be worrying about, not America. I'll attempt to translate some of it into plain English.

The basic problem is that Japan has borrowed wayyyyy too much money. They've been even worse than the US, and now owe more than twice their total GDP. They may, in the not too distant future, be forced either to default (stop making debt payments) or to print massive quantitites of new money, thus collapsing the value of the yen.

When you loan a government money by buying its bonds, there is always a risk that it will never give you your money back. You can buy insurance to protect yourself against the risk of not being paid back. It currently costs $63 per year for every $10,000 you've loaned to Japan (the loan in this case is for 5 years). That's a much higher insurance premium than for other major governments; the same sort of insurance only costs $22 if your loan was to the United States. These insurance costs for Japanese government debt have spiked higher just recently, a sign that people are becoming more doubtful about Japan being able to handle its debts.

Part of the problem is that the new left-leaning Japanese administration wants to... well, "borrow and spend," in an attempt to extricate the country from a horrible deflation. However good the intentions, Japan is already in debt up to its eyeballs and this is only making the fiscal situation more dire.

On top of the new round of borrowing and spending, Japan has a heck of a lot of elderly people, and various retirement funds are having to sell off Japanese government bonds in order to give people their retirement money. When all these old folks were still working, their pension funds were buying government bonds, i.e., they were loaning oodles of cash to the government. Now it's time for the government to start giving that money back.

And here we come to the Spooky Quotes section of the piece:

If Japan's bond rates rise to global levels of 3pc to 4pc, interest costs will shatter state finances.

No one knows exactly when a country tips into a debt compound trap. But Japan must be close....

"The debt situation is irrecoverable," said Carl Weinberg from High Frequency Economics. "I don't see any orderly way out of this. They will not be able to fund their deficit. There will be a fiscal shutdown, a pension haircut, and bank failures that will rock the world. It is criminally negligent that rating agencies are not blowing the whistle on this."

"Irrecoverable" is not a word one likes to see in an econ piece. It means, as I said earlier, that Japan is stuck with two really awful choices. It can default on its debt outright-- thus saying "Screw you!" to its lenders. Or it can print brand new money to pay its bills, eventually collapsing the value of the yen. When the yen gets decimated, that's essentially another way of defaulting, because although they will be paying people back, they'll be paying them back with toilet paper.

Now, I really doubt that they would simply stop making payments (default). If they did, the amount of interest that other major governments would have to pay to their lenders would shoot up rapidly, because everyone would be spooked. Government debt would no longer look like the "safe haven" investment it's assumed to be. People would be a lot more skittish about loaning money to governments, and would demand a lot more interest. Skyrocketing interest rates would completely crush stock markets, bond markets, and real economies worldwide. Frankly, I'm not sure Japan could even get away with it; other governments would presumably intervene somehow to avoid a catastrophic global deflation.

Option #2, then: Japan starts printing money to pay its bills. That dilutes the value of existing yen, so the value of yen starts to go down. This often ends in a sudden loss of confidence and Japan could then experience hyperinflation. When Thailand experienced a currency collapse in 1997 it spread to a number of other Asian currencies like an epidemic disease. If one of the world's major fiat currencies implodes, what happens to the others? Aren't all purely paper currencies impugned when one of them utterly falls apart? But if so, then this scenario might end in global hyperinflation; a collapse of all currencies (to varying degrees, but in all cases disastrous). Sure, there might be some little ones that would survive (maybe the Swiss would return to strict gold backing), but such currencies would not be plentiful enough to facilitate global trade as we've come to depend on it.

I certainly hope I'm missing something here. If Japan's situation is "irrecoverable" and if they could drag the rest of the developed world down with them, then it might not matter what Western central banks do from here on out.

Sunday, November 1, 2009

My UPS guy on the economy

About a week ago I was signing for a new printer, and my UPS guy asked me out of the blue whether we're stockpiling food. I'd seen this guy several times before, and I figured he'd delivered boxes from Emergency Essentials, Pleasant Hill Grain, BulkFoods.com... that sort of place. So he had a pretty good idea that we have a survivalist bent (although in our case, TEOTWAWKI arises not from nuclear war, Chinese invasion, or fire and brimstone, but currency failure). Mind you, we hadn't gotten any suspiciously survivalist boxes in a long time, and I wondered how long he'd been wanting to ask me this.

So I said yes, and admitted it. He nodded and recommended FoodInsurance.com for freeze-dried food. I recommended EmergencyEssentials.com and explained that our food isn't freeze-dried, it's mostly wheat and rice and dried beans and canned stuff. He said he's also been buying food at the regular old grocery store, stuff like mac and cheese and canned tuna. He explained that his dad lived through the Great Depression and we're headed that way again.

I started to say something about the dollar and he interrupted with "Yeah, they're gonna destroy it unless we can do something about these communists." I told him he could also buy silver, and it turned out he was already doing that. He'd been buying junk silver (old 90% silver dimes, quarters, half-dollars and dollars) because "that's currency, so they can't confiscate that." He was also saving old pennies (before 1982), which are 95% copper.

I mentioned the bankers, and he got on a tear talking about the Matt Taibbi article in Rolling Stone. He and I were mutually amazed that the other one had read it. And shortly thereafter he ran off to his truck, while I stood there realizing that my UPS guy knows more about the current economic situation than most people I know (even if you include the "communists" bit, where in my opinion the better term is "corporatists").

I think it's an excellent idea (if you can manage it) to lay aside food, silver, batteries, blankets, larger sized shoes / boots / coats for growing children, and so on. We don't know exactly what we're facing here, except that it's the end of an empire, and that's never pretty. I hope the idea of taking precautions is spreading.

For my family, this past week's precautionary purchases include two one-liter bottles of lamp oil (we have a very old-fashioned -- in fact, antique -- oil lamp) and two half-gallon jars of raw honey. Honey keeps forever. Oh, and 4 new LED flashlights, which don't eat batteries anywhere near as fast as our old incandescents.

And you?

Tuesday, October 6, 2009

Gold at record highs

Today's gold move was from about $1020 to an all-time record high of almost $1045. The reason for this, some speculate, is that journalist Robert Fisk -- one of my favorite journalists ever, by the way, constantly smeared by other Western journalists because he won't toe the line -- broke the news that a number of countries were meeting in secret to discuss moving away from the US dollar as the only currency in which to trade oil.

You may have heard the term "petrodollar," short for "petroleum-backed dollar." The idea is, since everybody but everybody needs oil, and you can only buy the stuff using dollars, everybody needs dollars. This maintains the dollar's status as reserve currency and it also supports its value by insuring demand.

If oil is routinely sold in anything other than dollars, then nobody has to have dollars anymore.

Most Americans don't have any clue what kind of danger our currency is in. They know about unemployment, bank bailouts, falling wages, store closings. But the idea that everything at China-Mart could double in price in 6 months (to choose a random hypothetical example) is not on their radar.

All of that said, I don't think this is "the big one," the point at which gold skyrockets and the dollar tanks, never to return. I still expect a stocks crash, a short dollar rally, and a major pullback in gold (although this pullback could be less than I'd been thinking, because the Chinese stand ready to buy gold whenever the price gets attractively low).

Silver, by the way, is known as the "poor man's gold," for being so much cheaper. It is currently undervalued relative to gold, meaning that not only are both precious metals expected to rise over the coming years, but silver should rise by even more. I wouldn't buy any silver just yet, because it could go off a cliff again if we have something similar to the fall of 2008. But if the price drops, go out and snatch up whatever silver you can. Sometime in the next few years (and possibly pretty soon) the world's post-WWII dollar system will fail.

Monday, October 5, 2009

Young and restive

With that in mind, this news from the Telegraph seems fairly alarming:

Youth unemployment has reached 39pc in Spain, 31pc in Lithuania, 28pc in Latvia, 26pc in Ireland and Slovakia, 25pc in Italy and Hungary, 24pc in France.

"There's tragedy unfolding here," said Julian Callow, Barclay’s Europe economist. "This is going to haunt the political outlook for years to come. Europe has been in denial about this because youth are not a powerful lobby like the unions, so they can be ignored.

Ignored, but not forever. In cases of massive unrest (as in Argentina) you see every kind of person on the streets, including elderly women banging pots with spoons. But in the early stages of unrest, in which windows are broken and cars torched, it's young people who carry it out. Consider Greece:

Data showed on Thursday nearly 18 percent of 15-29 year old Greek workers were unemployed in the second quarter, compared with 8.9 percent for the whole population and strongly up from last year.

The issue has proven explosive in the past. Last year leftists and young students took to the streets in Greece's worst riots in decades over the economy and the killing of a teenager by police. (source)

In 2005, riots broke out in many French cities and towns after police killed two teenagers. In that instance, racism and immigration played a role, but those issues are very much intertwined with unemployment and poverty. Young people are disproportionately without jobs and in poverty, both in the US and Europe, and young people have less to lose than older adults.

As the Barclay's economist said above, politicians have felt pretty safe ignoring teenagers and twenty-somethings. They don't vote (much) and have no lobbyists. But having this attitude today, as the world slips into economic Depression, is amazingly blithe.

Here in the US, the situation is worse than Spain or similar to Eastern Europe, depending on the color of your skin:

The September teen unemployment rate hit 25.9%, the highest rate since World War II and up from 23.8% in July. Some 330,000 teen jobs have vanished in two months. Hardest hit of all: black male teens, whose unemployment rate shot up to a catastrophic 50.4%. It was merely a terrible 39.2% in July. (source)

Like I said, racism, immigration, poverty, unemployment-- it's all interconnected, and it's a tinderbox. (It would be helpful if police the world over would stop killing unarmed teenagers, which tends to spark violence; but I'm not optimistic.)

Having some sort of mandatory military service (as the White House Chief of Staff wants), or mandatory civil volunteering, or any other sort of "youth brigade" could become a popular idea if we begin to see destructive protests among teenagers and young adults. (One wonders about the color of their uniforms and whether they will have a special salute?) The military poverty draft is already useful to the establishment as a means of neutralizing -- in one way or another -- poor and potentially angry teenagers.

The thing to get into our heads, I suppose, is that the kids we will one day see on television throwing the tear gas canisters back into the police ranks would truly rather be working, making a living and making their way in the world. In some ways the US is better off than Europe in the longer term, because although we don't produce anything now, we could start making stuff. And that will eventually provide more jobs for those who are 17 or 19 today.

Saturday, October 3, 2009

Nothing has been fixed

The theme of the interview is that "green shoots" are a joke, because we have not fixed anything. We haven't increased US production. We are not, in truth, really trying very hard to halt foreclosures. Nothing has been done about derivatives, many of which are a kind of insurance against rising interest rates. If interest rates do rise, as at some point they must, it will obliterate the major banks (again). The central banks are already talking about how to repair the derivatives nightmare with -- you guessed it -- newly printed bailout money.

The most striking thing Willie said was that he thinks the Fed is buying 60 to 80% of all Treasuries. Holy cow. If that is true, there is no way to avoid Weimar now. It's too late.

No, nothing has been fixed, unless you think printing money is the solution to every problem.

You'd better have food stored.

If you start accumulating things now, picking up extra TP and some canned soup and a bag of dried beans every time you go to the store, or taking advantage of that sale on batteries or the 2-for-1 fleece blankets, you have time enough to gather a good deal together. If you think this is silly, visit some preparedness sites to see what the other end of the spectrum looks like.

Friday, October 2, 2009

But wait, it gets worse

This morning the actual number came in at 263,000 jobs lost last month. Worse than the worst of economists' estimates, and a heck of a lot worse than the median prediction. Most likely, this number will be revised in the next month or two and will look even worse still, as that's what usually happens.

Of course, these numbers are the finagled, "adjusted" numbers. The government uses the "birth-death model" (meaning the birth or death of businesses) to change the estimate. Much later, after certain tax data has become available, they can tell us whether their adjustments got us any closer to the truth. Well, the government thinks that from March 2008 to March 2009 we actually lost 824,000 more jobs than their "adjusted" estimates had thought. So you can bet that this 263,000 figure is considerably too rosy, as well.

Karl Denninger has looked at some of the unadjusted data (all emphasis his):

But the Household Data is VASTLY worse than reported. Here are the month-over-month changes, and they're in the realm of frightening. (all numbers in thousands)

Civilian Labor Force: 154,879 to 153,617 this month.

Employed: 140,074 down to 139,079 this month.

That's a loss of 995,000 jobs, not 263,000, and the labor force contracted by 1,262,000 people!

The participation rate was absolutely decimated, down 0.6% this last month alone. The people "not in the labor force" rose by a staggering 1,516,000 in the last month.

The government doesn't count people as "unemployed" who have given up and exited the labor force, but as I have repeatedly noted, whether the government counts them or not, the corner store owner sure as hell does!

The fact of the matter is that nearly 1 million fewer people were working in September as compared to August; there has been absolutely no improvement in that trend whatsoever.

It also turns out that average hours worked per week (among those lucky enough to be employed) fell another tenth of an hour, with a corresponding small decline of $1.54 in average weekly income. It's a tiny decrease per individual, but multiply that by 140 million workers and you get $216 million per week which is no longer available for consumer spending. That income loss does not count the unemployed; that's the income loss per week among those who still have jobs.

To have a real recovery the working and middle classes must have larger incomes, which means we must have higher wages and less unemployment. That means we must produce more. No more "service economy" or "post-industrialist economy" nonsense.

(It's true that there's one other way to become wealthier as a nation, and that's to simply loot and plunder other nations. But I think America's days as an empire are coming to an end, so that's out.)

No other choice but to grow things, mine things, and make things.

Thursday, October 1, 2009

Choose your poison

The US Treasury would like to borrow $138 billion next week. That is, they want to print some IOU's and take people's money and promise to return it with interest.

Recently, the Federal Reserve has been providing almost half of these loans to the US government, using brand new money, invented out of thin air. It's not that the Fed really wants the IOU's, it's that nobody else wants them.

This arrangement with the Fed is known as "quantitative easing" or QE. (A leading Scottish money manager recently said: "Quantitative easing is a phrase which bears the same relationship to ‘printing money’ as ‘terminological inexactitude’ does to ‘lie’.")

Trouble is, QE was not an infinite program. The Fed says it's being wrapped up now and is coming to an end. Only $7 billion more can be spent buying Treasuries this way. And -- not to belabor the obvious -- but $7 billion is a far cry from half of $138 billion.

So what if we can't sell our IOU's for some fast cash? What happens if people look over the Treasuries and say "No thanks," and there's no Fed to ride in and save us?

Well, they wouldn't exactly say "No," they'd say "You look like a shady character, so I'll give you the money, but only if you pay me a heck of a lot of interest to make it worth the risk." So instead of borrowing money at some measly amount like 2%, we get the loan all right, but we have to pay 4%. Or 6%. Or 10%. Who knows, once confidence is lost?

This is Poison #1: Rising Interest Rates. The housing market was just starting to pop its head out of the bunker to see if the smoke had cleared, and here come high interest rates to discourage home sales, make refinancing even less feasible, and crush adjustable-rate mortgage holders. Not good. And the federal budget deficit would balloon even more quickly than it has been.

Alternatively, we could simply revert back to QE again and let the Fed step in and buy debts within a new, emergency round of money-printing. This is Poison #2, and it would be very risky. Words like "Armageddon" are being used (video) to describe what happens if we piss off China and Japan enough that they start refusing to buy our bonds. And they would certainly be pissed. Nobody wants to be paid back in Weimar-like currency, which is to say, kindling. Run the printing press enough, and you're on the path to currency collapse.

Poison #3 has political and economic ramifications, but is the least unpredictable and least chaotic of the options. And it would cause a dollar rally, smash the gold price temporarily, and please our foreign creditors. It's the simplest thing, really-- you just push the stock market off a cliff. Have Goldman hurry it along so it can be out of the way by Oct 7 or 8 when we have to sell some longer-duration IOU's that nobody would otherwise buy. Make stocks plummet (which was inevitable anyway, just a matter of timing), and investors and fund managers panic and race into Treasuries as a "safe haven." Problem solved, for the time being.

Of course, political approval ratings and consumer confidence are heavily dependent on stock markets. Pension funds, 401k's, university endowment funds, and some municipal funds will all suffer. It's not good political policy to enrage the middle class, as it's the middle classes who engender revolutions. But the first two options risk chaos on the international scene. Nobody likes the dollar, but as it is the world's reserve currency and foreigners are in possession of around 2/3 of all dollars in existence, everyone would prefer that it die an orderly death.

So that's how I see the dangers in the next 10 days. (There may be a less awful scenario that I haven't thought of, like working out a back-room deal with EU nations, but I can't envision how that would work.) We could see rising interest rates, or money-printing and a plunging dollar, or a crash in stocks bad enough to cause panic. If you've been reading the blog, you know how I feel about stocks.

[Addendum: Immediately after posting I went to Zero Hedge and saw that Goldman just revised its estimate of job losses from 200,000 jobs gone to 250,000 jobs gone. A bad jobs number, coming on top of today's bad day in stocks and other bad econ data this week, could set off the downturn in equities.]

Sunday, September 27, 2009

Headlines from the Real Economy

[U]nemployed Americans now confront a job market that is bleaker than ever in the current recession, and employment prospects are still getting worse.14.5 million unemployed does not count the long-term unemployed or those who have given up because there are no jobs in their area. The real ratio of unemployed to available jobs might be closer to 10 to 1.

Job seekers now outnumber openings six to one, the worst ratio since the government began tracking open positions in 2000. According to the Labor Department’s latest numbers, from July, only 2.4 million full-time permanent jobs were open, with 14.5 million people officially unemployed.

35 Million Americans on Food Stamps

The raw data shows us that a stunning 12 percent of our entire population is receiving some form of food stamp assistance.... This is the highest percentage of Americans receiving food stamps since records started being kept back in 1969.

A Surge in Homeless Children Strains Schools

Charity [Crowell] is one child in a national surge of homeless schoolchildren that is driven by relentless unemployment and foreclosures. The rise, to more than one million students without stable housing by last spring, has tested budget-battered school districts as they try to carry out their responsibilities — and the federal mandate — to salvage education for children whose lives are filled with insecurity and turmoil....Housing Crash to Resume on 7 Million [New] ForeclosuresWhile current national data are not available, the number of schoolchildren in homeless families appears to have risen by 75 percent to 100 percent in many districts over the last two years....

With schools just returning to session, initial reports point to further rises. In San Antonio, for example, the district has enrolled 1,000 homeless students in the first two weeks of school, twice as many as at the same point last year [emphasis mine].

The crash in U.S. home prices will probably resume because about 7 million properties that are likely to be seized by lenders have yet to hit the market.....

The "huge shadow inventory," reflecting mortgages already being foreclosed upon or now delinquent and likely to be, compares with 1.27 million in 2005.....

Assuming no other homes are on the market, it would take 1.35 years to sell the properties based on the current pace of existing-home sales....

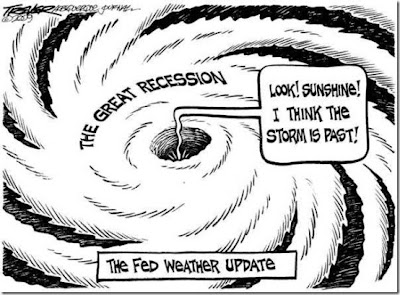

Meanwhile, in La-La Land, we have headlines like this:

Bernanke: Recession "Likely Over"

Federal Reserve Chairman Ben Bernanke said Tuesday that the recession was "very likely over," as consumers showed some of the first tangible signs of spending again.These "tangible signs of spending," which apparently prompted Bernanke to pronounce the end of the recession, were based on August retail sales figures. That is, August sales looked better than July sales. Of course, as usual with government statistics, it was all the sheerest nonsense. Let's take a look at this August data:

So we sold more cars. Yeah, no kidding! That was part of a little thing called Cash for Clunkers. (Notice, however, that even with Cash for Clunkers we still sold slightly fewer cars than in August 2008.) And we sold more gasoline too, although notice that compared to August 2008, gas stations sold 27% less (wow!!). And, continuing down the chart, 6 of the next 7 "better than July" categories were also down compared to the same month in 2008.

Econo-bloggers have started to comment on this trend of looking only at month-to-month changes, which sometimes show small improvements, rather than the usual year-over-year changes. Because of simple variability and certain seasonal trends, there's usually some economic statistic somewhere which showed a slight improvement since last month. It's the year-over-year figures that show we've not had any real recovery.

Back to the chart-- the remaining improved category of restaurant and bar sales, which actually was up even on a y-o-y basis, was surely not enough to outweigh the drops in building materials, garden supplies, furniture, and furnishings.

Basically we're hanging our "recession is over!" hats on a measly 0.3% increase in fast food purchases and bar tabs from July to August. Or, to be fair, a 0.7% increase compared to August 2008.

Damn slim data on which to come out publicly and declare the end of the recession. Mr. Bernanke needs to take his egghead out of the ivory tower and go spend a weekend in a place like Gary, Indiana or Flint, Michigan.

[T]here are indications that the severest phase of the recession is over.

-- Harvard Economic Society, January 18, 1930

Saturday, September 26, 2009

Overpriced stocks

Bearing that in mind, take a look at these hideous graphs (click to enlarge), from a long report titled Economic and Financial System Train Wreck Dead Ahead:

It's not that stock prices have gone up astronomically. The Dow and S&P (which are aggregate price measures) are still far below the highs they reached in 2007. What's happened, of course, is that earnings have plunged precipitously:

Check out the x-axis. This chart goes back 75 years. Nothing even remotely like this has happened since the Great Depression.

So why have stocks kept up these price levels? If earnings are down 98% since the 2007 highs, why are stocks down only around a third? Is this why Congressman Grayson asked the Fed whether they manipulate stock markets?

Stocks have not been rallying because there is any sort of recovery underway. Numbers may tack up or down a little bit, they may vary from one month to the next, they may appear to improve temporarily because of bailouts or foreclosure moratoriums or Cash for Clunkers. But there is no recovery. Eventually stocks will have to "correct" to reflect reality.

Friday, September 25, 2009

Workers running out of unemployment benefits

According to the BLS, the exhaustion rate, or the number of people who have used up their benefits, and will no longer be receiving unemployment checks, has hit an all time high of 52.40% for August.

In other words, over half of those who lose their jobs cannot find a new job before their benefits expire. What they do then is anyone's guess. I suppose they move to tent cities or become hobos (on the railcars that are still moving, that is).

This is a staggering number, and whats worse it was grown in practically a linear fashion with not even a hope of a second (third or fourth) derivative green shoot in sight. In fact, the deterioration in "employability" is accelerating. And yet assorted "pundits" claim the employment picture is improving.

They talk about a "jobless recovery" and the "post-industrialist economy," so the natural next step is the phrase "jobless economy." You'll hear it on CNBC first!

Thursday, September 24, 2009

Ghost railcars

The above line of rail cars is 2 miles long and has divided New Castle, Indiana for many months. They used to transport autos, back when this used to be a Chrysler town.

The above is a line of hundreds of railcars in Montana, parked (helpfully) near a popular tourist fishing locale. Has anyone considered what effect a huge iron wall might have on moose, elk, or deer?

The above is in Colorado....

And taking the prize, the above railcars (built to haul lumber) lie in a thirty mile stretch through Oregon's otherwise beautiful wilderness. Quoting from the article where I found this image:

The situation is a snapshot of a national picture. The economic slump has idled about 70,000 Union Pacific railcars, now sidetracked wherever space can be found, said Zoe Richmond, a Union Pacific spokeswoman in Roseville, Calif. The railroad has also furloughed 5,000 of its 48,000 workers. Other railroads are in the same predicament, she said.

Back to back, Union Pacific's idled railcars would reach from Seattle to Albuquerque, N.M.

"We don't have 2,000 miles of track anywhere in our system to put them," Richmond said. "Unfortunately, the stored cars are really just a big visual reminder of our current economic situation."

Uh, yeah. Not too good.

Zero Hedge did a post on how railcar traffic has fallen since 2008. It's fallen so much, in fact, that we've gone all the way back to 1993 railcar volumes.

Specifically, in the first 36 weeks of 2009, we've shipped 22% fewer carloads of grain, 23% fewer carloads of farm products other than grain, and 13% less "food and kindred products" than we did in the same 36 weeks of 2008. Now, I think we shipped a little less grain because we shipped less corn bound for ethanol-fuel plants. And, partly, the temporarily stronger dollar made our exported grain more expensive for other countries, so perhaps we exported less, which meant we shipped less. Even so, these statistics seem to imply that somebody, somewhere, has cut back on the food they're eating.

We've shipped 9% less coal this year. Perhaps that was because it was cool (meaning less AC, so less electricity required). But I tend to think of dark, empty shops and houses when I see that coal shipping has fallen 9%. Energy is the lifeblood of any economy, and our electricity usage has clearly fallen off... so what does that say?

Railcars of lumber were down 37%, and cars of "crushed stone, sand, and gravel" were down 22%. Casualties of the disaster in real estate.

Pulp and paper shipments were down 21%. Fewer operating offices, I presume.

Metals & metal products were down 53% (!!), which has to mean that manufacturing is way off. And I mean way off, not "GDP declined by 1%" or similar bullshit, but way off. Even after considering the steel and iron that did not go into construction, that can't account for a 53% decline. This is a hideous number.

Putting aside the government's lies, damned lies, and statistics, things do not look good. As they say: It's the real economy, stupid.

Wednesday, September 23, 2009

The economy is a lie

Americans cannot get any truth out of their government about anything, the economy included. Americans are being driven into the ground economically, with one million school children now homeless, while Federal Reserve chairman Ben Bernanke announces that the recession is over.

You've heard of a "jobless recovery"? This is the "recoveryless recovery."

The spin that masquerades as news is becoming more delusional. Consumer spending is 70% of the US economy. It is the driving force, and it has been shut down. Except for the super rich, there has been no growth in consumer incomes in the 21st century. Statistician John Williams of shadowstats.com reports that real household income has never recovered its pre-2001 peak.

Instead of using income to make purchases, Americans began relying on home equity, credit cards, and ever-larger student loans. Every kind of debt we had access to, we took on... not that, you know, we could actually pay it back. (I'm not necessarily blaming consumers here, because many of them were told by knowledgeable-sounding suits that these debts were acceptable and nothing to worry about. Nor have most people received any education about finance or economics, which if you ask me, is by design.)

This debt party is now at an end.

As consumers no longer can expand their indebtedness and their incomes are not rising, there is no basis for a growing consumer economy. Indeed, statistics indicate that consumers are paying down debt in their efforts to survive financially. In an economy in which the consumer is the driving force, that is bad news.

Later in this piece (please click through-- it's a great essay) Roberts says that he can't see how unemployment is going to get back below 20+%, because the work has been sent overseas. The problem isn't idled factories, waiting for a pick-up in the general economy (or easier financing) so they can get back to work. The problem is a lack of factories.

Sometimes I'd like to wring the neck of whatever smug economist coined the term "post-industrialist economy." What kind of bozo thinks you can have an economy without producing anything? We might as well talk about the post-food diet.

I doubt that the US could turn to older methods of job creation, such as massive-scale works projects or tariffs and protectionism. We cannot risk further debasing the dollar by taking on massive debts to fund the next Tennessee Valley Authority. Nor can we withdraw from the WTO and piss everyone off with protectionist measures. We're far too dependent on the rest of the world to take our dollars, and to sell us oil in return for dollars.

There's a third way jobs can be created... eventually. But we aren't going to like it. A failing dollar would drive up the cost of imports, forcing us to turn back to domestic production and the rebuilding of a manufacturing sector. If we have the very best of luck, the dollar will lose half its value in an orderly manner. If we have bad luck, the dollar will plunge in value in a disorderly manner until it is worth nothing, leaving utter chaos, riots, and hungry people in its wake. I presume that if the worst happens, the next American currency will be pegged to the gold-backed yuan. Once that's settled, we'll go back to making and growing things again.

It would be nice to avoid the worst of all outcomes (total destruction of the currency), but as everyone in Washington seems to believe their own lies about the economy, I'm not too sanguine.