[U]nemployed Americans now confront a job market that is bleaker than ever in the current recession, and employment prospects are still getting worse.14.5 million unemployed does not count the long-term unemployed or those who have given up because there are no jobs in their area. The real ratio of unemployed to available jobs might be closer to 10 to 1.

Job seekers now outnumber openings six to one, the worst ratio since the government began tracking open positions in 2000. According to the Labor Department’s latest numbers, from July, only 2.4 million full-time permanent jobs were open, with 14.5 million people officially unemployed.

35 Million Americans on Food Stamps

The raw data shows us that a stunning 12 percent of our entire population is receiving some form of food stamp assistance.... This is the highest percentage of Americans receiving food stamps since records started being kept back in 1969.

A Surge in Homeless Children Strains Schools

Charity [Crowell] is one child in a national surge of homeless schoolchildren that is driven by relentless unemployment and foreclosures. The rise, to more than one million students without stable housing by last spring, has tested budget-battered school districts as they try to carry out their responsibilities — and the federal mandate — to salvage education for children whose lives are filled with insecurity and turmoil....Housing Crash to Resume on 7 Million [New] ForeclosuresWhile current national data are not available, the number of schoolchildren in homeless families appears to have risen by 75 percent to 100 percent in many districts over the last two years....

With schools just returning to session, initial reports point to further rises. In San Antonio, for example, the district has enrolled 1,000 homeless students in the first two weeks of school, twice as many as at the same point last year [emphasis mine].

The crash in U.S. home prices will probably resume because about 7 million properties that are likely to be seized by lenders have yet to hit the market.....

The "huge shadow inventory," reflecting mortgages already being foreclosed upon or now delinquent and likely to be, compares with 1.27 million in 2005.....

Assuming no other homes are on the market, it would take 1.35 years to sell the properties based on the current pace of existing-home sales....

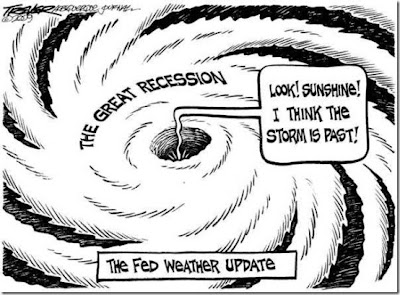

Meanwhile, in La-La Land, we have headlines like this:

Bernanke: Recession "Likely Over"

Federal Reserve Chairman Ben Bernanke said Tuesday that the recession was "very likely over," as consumers showed some of the first tangible signs of spending again.These "tangible signs of spending," which apparently prompted Bernanke to pronounce the end of the recession, were based on August retail sales figures. That is, August sales looked better than July sales. Of course, as usual with government statistics, it was all the sheerest nonsense. Let's take a look at this August data:

So we sold more cars. Yeah, no kidding! That was part of a little thing called Cash for Clunkers. (Notice, however, that even with Cash for Clunkers we still sold slightly fewer cars than in August 2008.) And we sold more gasoline too, although notice that compared to August 2008, gas stations sold 27% less (wow!!). And, continuing down the chart, 6 of the next 7 "better than July" categories were also down compared to the same month in 2008.

Econo-bloggers have started to comment on this trend of looking only at month-to-month changes, which sometimes show small improvements, rather than the usual year-over-year changes. Because of simple variability and certain seasonal trends, there's usually some economic statistic somewhere which showed a slight improvement since last month. It's the year-over-year figures that show we've not had any real recovery.

Back to the chart-- the remaining improved category of restaurant and bar sales, which actually was up even on a y-o-y basis, was surely not enough to outweigh the drops in building materials, garden supplies, furniture, and furnishings.

Basically we're hanging our "recession is over!" hats on a measly 0.3% increase in fast food purchases and bar tabs from July to August. Or, to be fair, a 0.7% increase compared to August 2008.

Damn slim data on which to come out publicly and declare the end of the recession. Mr. Bernanke needs to take his egghead out of the ivory tower and go spend a weekend in a place like Gary, Indiana or Flint, Michigan.

[T]here are indications that the severest phase of the recession is over.

-- Harvard Economic Society, January 18, 1930